Three pieces of analysis suggest trouble for the growth of low-carbon energy sectors, as we continue gauging the ongoing effects from the coronavirus pandemic.

State of play: Several industry groups and analysts issued a memorandum tallying the early stages of U.S. job losses in the sector at 3% already. Meanwhile, an intergovernmental agency warns that COVID-19 could hinder oil industry efforts on climate and a group of business leaders said 84% of their members have delayed projects.

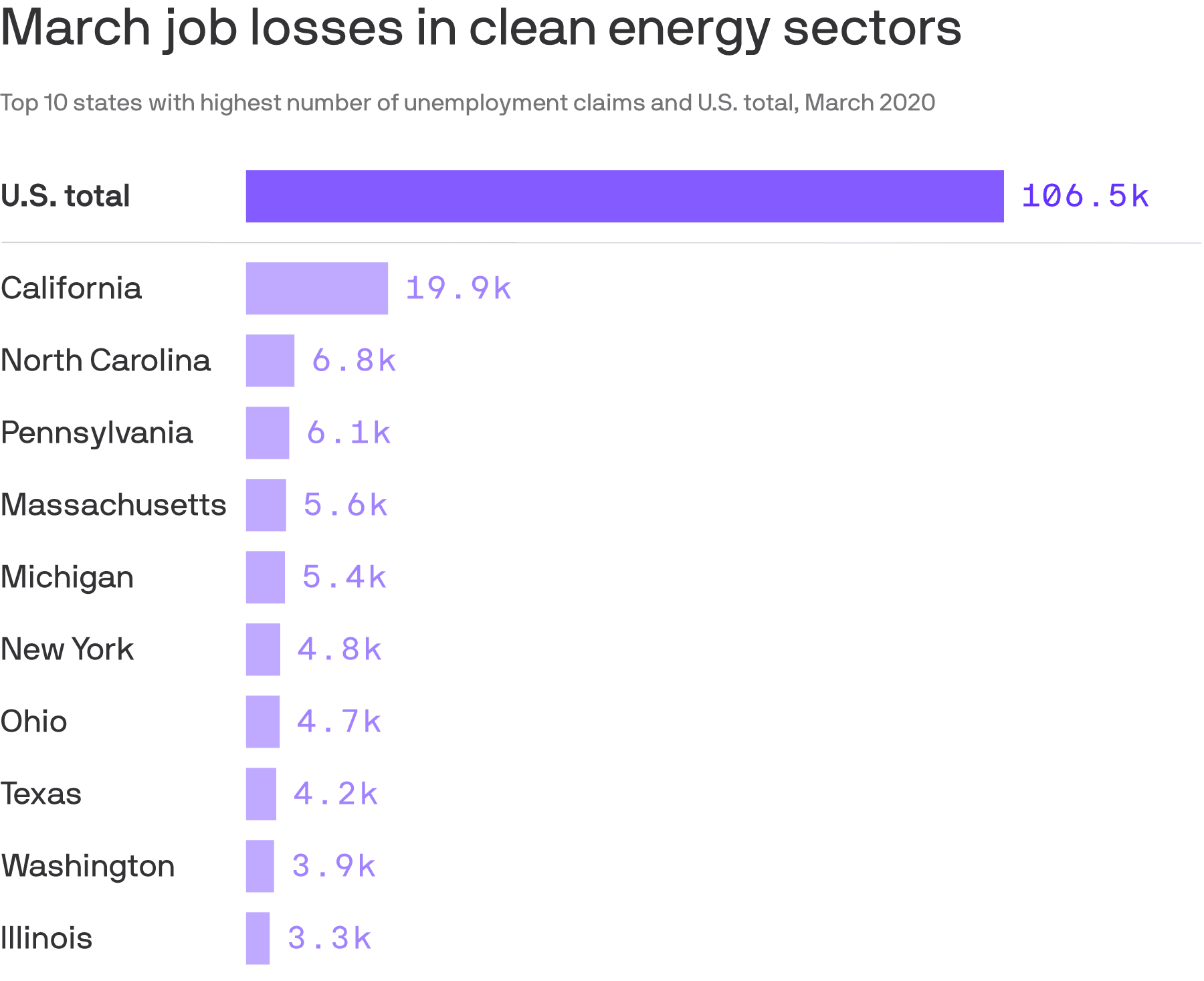

1) A BW Research Partnership report concludes that over 106,000 workers lost jobs last month across several broad categories: efficiency, renewable power, alternative fuels, storage and grid tech, and electric cars.

- Types of jobs lost include electricians, panel installers, wind industry technicians, manufacturing workers and more, with the efficiency sector taking the biggest hit.

Why it matters: The BW analysis provides a wide-angle look at the various reports emerging of how the economic contraction and movement restrictions are affecting these sectors.

- The 106,400 jobs lost across these sectors in March represents an immediate 3% drop in employment, but there's more to come, according to BW.

- "Unfortunately, this only captures the initial impacts of the COVID-19 crisis and does not include many temporarily furloughed or underemployed workers; job losses in clean energy will continue to grow into the coming months."

What's next: They estimate that the sectors identified could lose a combined half a million jobs in the months ahead absent new support.

- The report comes as the renewables sector has been urging lawmakers — without success so far — for help as part of the wider economic response to COVID-19.

- They're seeking relief from deadlines to take advantage of tax incentives, and the ability to quickly monetize those credits.

More broadly, there's a push in multiple regions, including the EU, to have economic rescue packages boost low-carbon energy. It comes as the sector is taking a hit worldwide.

- For instance, the consultancy Wood Mackenzie's revised projections this week note that "2020 solar installations have been revised down by 18% from pre-coronavirus levels from 129.5 GW to 106.4 GW."

2) The International Energy Agency's monthly oil market report sounds the alarm about the diversification efforts of the world's largest oil-and-gas companies.

- "Global capital expenditure by exploration and production companies in 2020 is forecast to drop by about 32% versus 2019 to $335 billion, the lowest level for 13 years," the Paris-based agency noted.

- "This reduction of financial resources also undermines the ability of the oil industry to develop some of the technologies needed for clean energy transitions around the world."

3) The trade group Advanced Energy Economy released a survey about the effects of COVID-19 on their members.

- It finds that "84% of companies have had to stop or delay projects," while nearly half have had "customers or clients cancel or delay projects through force majeure."

What's next: They estimate that the sectors identified could lose a combined half a million jobs in the months ahead absent new support.

California has seen the steepest initial job losses in the broadly defined "clean energy" sector, per BW analysis of unemployment claims filed in March.