The list of merchants that accept Bitcoin is continuously expanding. However, it’s still not possible to purchase everything with Bitcoin. But you can now order your own Bitcoin debit card, thanks to several companies in the Bitcoin ecosystem.

It’s as simple as it sounds. Bitcoin debit cards help bridge the Bitcoin world with traditional finance. You can simply load a debit card with bitcoins or altcoins and spend them at almost any credit card accepting merchant.

It is incredibly easy to buy stuff with a crypto debit card and you will see how further down in this article.

Bitcoin debit cards do not allow users to spend bitcoins directly. However, they at least allow people to store balances in bitcoin.

Bitcoin balances can be held up until the need to spend because most debit card top ups only take a couple of seconds to confirm.

In this article, we’ll take a look at seven of the market’s best Bitcoin debit cards. Bitcoin has made a lot of progress in seven years, and perhaps in the year 2025, the vast majority of the mainstream world will offer a Bitcoin payment option just as ubiquitously as they do PayPal. The world still runs on plastic. That’s why the Bitcoin business community has begun to offer more and better debit card options over the last three years.

Before we list best bitcoin cards, let’s quickly glance over the benefits of these services.

Pros of Using a Bitcoin Debit Card

The pros are pretty obvious. Now, any place that accepts credit or debit cards would accept your Bitcoin debit card as well, which means that you can now buy virtually anything with Bitcoin. The merchants get paid in their own currency by the debit company and the charge will be deducted from your Bitcoin balance, which allows you to live purely on Bitcoin.

For example, Bitcoin debit card is like the traveller’s check of the digital age. I always take my Bitcoin debit card when I travel abroad, as a backup card in case my money gets stolen.

Cons of Using a Bitcoin Debit Card

Centralization is the major con of a Bitcoin debit card. You need to deposit money into your account at the debit card company in order to use the crypto card. This means you’re giving control over your coins to a 3rd party. This risk is decreased by not depositing too many Bitcoins into your balance. Basically, you should deposit only an amount you can afford losing in case of a hack. Also, since you are using the service of these companies it comes with a price. This means that you can’t ignore the fees that Bitcoin debit card companies charge.

There are loads of crypto cards currently available but this lists consists only of the best bitcoin debit card providers. Here’s a short summary of each one and their pros and cons.

Complete list of working best bitcoin cards in 2020

Coinbase Visa Debit Card

The new Coinbase Card is directly tied to a person’s cryptocurrency balance in digital wallets managed by the eponymous digital currency exchange. This is the latest product launched by the leading crypto exchange – Coinbase. Thanks to its huge reputation in the crypto world, Coinbase card is probably the best bitcoin debit card you can get (if you’re lucky and live in a country that is supported with this service).

| Coinbase Bitcoin Debit Card | |

| Availability | UK, Selected EEA |

| Supported Currency | EUR, GBP, BTC |

| Card Options | Physical |

| Card Type | Visa |

| Fees | Medium |

| Native Token | No |

| Perks/Bonuses | No |

The crypto card will be associated with a users Coinbase account via a separate Coinbase card mobile app that is available for both iOS or Android. The cards can be used to withdraw cash at any VISA-supported ATM’s worldwide and make point-of-sale (POS) payments with either ‘chip and pin’ or contactless technology.

There’s a 2.49 percent fee charged for each transaction using the card – made up of 1.49 in conversion fees and one percent transaction fee. However there are no maintenance fees and no additional cost for ATM withdrawals – but you will need to withdraw less than £200 per month.

Using the card in other European countries will incur a 2.69 percent fee, and outside of Europe will see a 5.49 percent charge. Coinbase says it is planning to roll out the card to other European countries soon, but there are no plans for a US launch just yet.

Wirex Visa Debit Card

Wirex is a card company that offers its users USD, EUR and GBP and cryptocurrency debit cards to ease the use of traditional and digital money. They are one of the most established providers of crypto cards and their piece of plastic can definitely be considered as one of the best bitcoin cards.

The cryptocurrency debit card allows BTC, ETH, XRP and LTC deposits which can be converted to fiat currencies at live rates. The cards are delivered free worldwide on order, users will pay $1.50 USD management fee per month afterwards to cater for the operational costs.

| Wirex Bitcoin Debit Card | |

| Availability | EEA |

| Supported Currencies | USD, EUR, GBP, BTC |

| Card Options | Physical/Virtual |

| Card Type | Visa |

| Fees | Low |

| Native Token | WXT |

| Perks/Bonuses | 0.5% Cryptoback |

Other Wirex debit card fees include $2.50 USD for any ATM withdrawal within Europe and $3.50 USD for withdrawals outside of Europe. Online and offline payment for goods and services is not charged.

Bitcoin users are eligible to the Cryptoback program that returns 0.5% of your Bitcoin every time you punch in your pin, swipe, or use contactless pay with the Wirex VISA bitcoin debit card. The Wirex cryptocurrency card can be accepted around the world anywhere VISA is accepted.

PROS:

- The availability of many options of cryptocurrency and fiat payment systems.

- Wirex is an established card company.

- The Wirex mobile app offers efficient transactions to users. The app can be downloaded from Google Play Store, Apple Store or open an online account with Wirex.

CONS:

- Only available in Europe locking out other investors worldwide.

- The management fee is quite high.

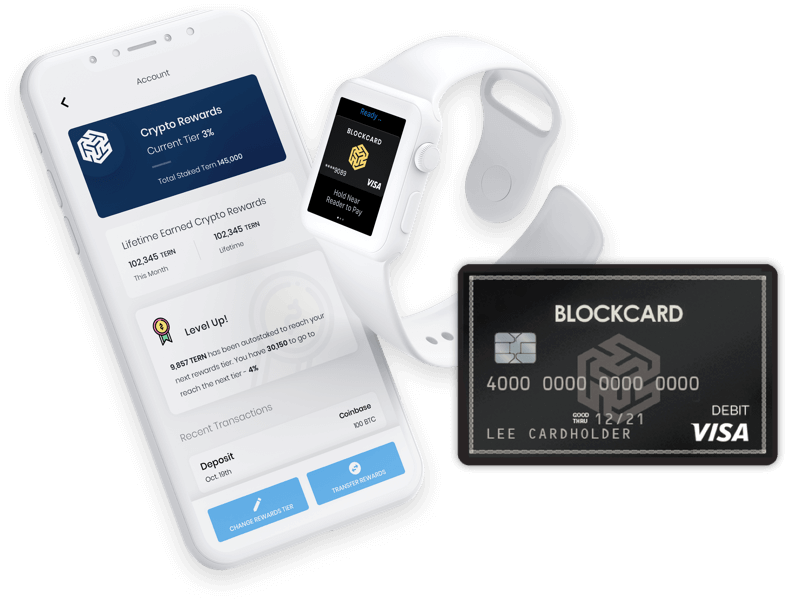

BlockCard

BlockCard is a cryptocurrency debit card issued by a company called Ternio LLC. It is currently available in the USA and soon will support customers from the EU as well. BlockCard offers a range of products: wallet, virtual debit card, plastic card and metal card.

The card supports 13 different cryptocurrencies that can be deposited on your BlockCard and used as a paying mean at all VISA terminals as the card converts your crypto into dollars in the background. You can use it at any place that accepts Apple Pay, Google Pay, or Samsung Pay.

| BlockCard Visa Crypto Debit Card | |

| Availability | USA |

| Supported Currencies | USD + 13 cryptocurrencies |

| Card Options | Physical/Virtual |

| Card Type | Visa |

| Fees | Free or $5/month |

| Native Token | TERN |

| Perks/Bonuses | up to 6.38% APY Cryptoback |

One of the great features of this crypto card is its ability to send crypto instantly to anyone who has BlockCard account. You just need his username to do it. It works without BlockCard account as well, as the receiver gets a link through which he can redeem his crypto you sent him.

Just like all other crypto debit cards listed here, this one requires KYC as well but the process is automatic and you are registered with BlockCard within 5 minutes.

Another big advantage of BlockCard is the fact it charges no fees on deposits, withdrawals or transactions. Instead, they charge a flat monthly rate and for most users, that fee is waived by using BlockCard Visa Bitcoin Debit Card. Please note that banking partners of Ternio/BlockCard do charge their fees so ATM withdrawals and balance inquiries do incur a fee ($3 and $0.50 respectively).

Monthly fee for the plastic card is $0/month for spends over $750 with a $500 daily ATM withdrawal limit and $5,000 spending limit. For spends below $750, the fee is $5 per month.

The metal card is yet to be released so there are no details on it as yet.

Rewards – This is probably most attractive feature of BlockCard. Thanks to their TERN token staking program, you can get a 6.38% annual reward by using the card and staking TERN token. Rewards are dependent on the amount of TERN tokens you stake with BlockCard and range from 1% to 6% APY. Thanks to their well-designed rewards program, BlockCard is definitely a serious candidate for the best crypto card of 2020.

PROS:

- Flat monthly fee

- Attractive cashback rewards

- Wide range of supported cryptocurrencies

CONS:

- Currently only available in the USA

Cryptopay Debit Card

The Cryptopay bitcoin debit card is the oldest and most established Bitcoin debit card, with over 23,000 issued. The CryptoPay card comes up first in the results if you look up “Bitcoin debit cards” in Google. Let’s see if that means it is the best bitcoin card!

| Cryptopay Bitcoin Debit Card | |

| Availability | EEA |

| Supported Currencies | USD, EUR, GBP, BTC |

| Card Option | Physical/Virtual |

| Card Type | N/A |

| Fees | Medium |

| Native Token | No |

| Perks/Bonuses | No |

Cryptopay supplies a Bitcoin debit card that is available worldwide, and this card has made it simple for customers to spend bitcoins at millions of businesses around the world.

Benefits include access via the three major currencies, and the card can be bought with these currencies, or with Bitcoin. The card price is slightly above average, at $15, and it is shipped for free anywhere in the world. ATM withdrawal costs $2.5. Also, international currency change adds another 3% on each transaction. You can either order a virtual debit card if you’re just into online shopping, or a physical card with a chip & pin. Another great bonus of Cryptopay is that if you don’t need high card limits, you do not have to supply full ID verification.

For buys both offline and online, Cryptopay makes the process convenient for users and easier than ever for merchants, and in Europe you’ll get faster delivery times (about 5 business days).

PROS:

- Supplies both physical and virtual cards

- Available worldwide

- Access via the three major currencies

CONS:

- Maintenance and load fees

- You can only load up to €2500 in your card if you’re not verified

Crypto.com MCO Visa Card

This is a card offered by the formerly known Monaco Coin team – it works in pair with the MCO wallet. You can then spend cryptocurrency seamlessly at the over 40 million retailers globally who accept Visa.

| MCO Bitcoin Debit Card | |

| Availability | Singapore/USA |

| Supported Currency | USD, BTC |

| Card Options | Physical |

| Card Type | Visa |

| Fees | Low |

| Native Token | MCO |

| Perks/Bonuses | Cashbacks & Discounts |

The list of advantages for Crypto.com card holders rivals that of any of the best Visa rewards cards. Users can use this Visa card with no annual fees, get free shipping, receive up to 2% cashback on purchases, and select cards get unlimited airport lounge access.

Users also have the ability to spend overseas and receive interbank exchange rates. And with the Platinum Referral Reward Program it’s possible for users to receive up to $10,000 sign-on bonus!

The biggest drawback – it currently works only in Singapore with EU zone next on the waiting list. USA and the rest of the world are not even in the queue as of right now.

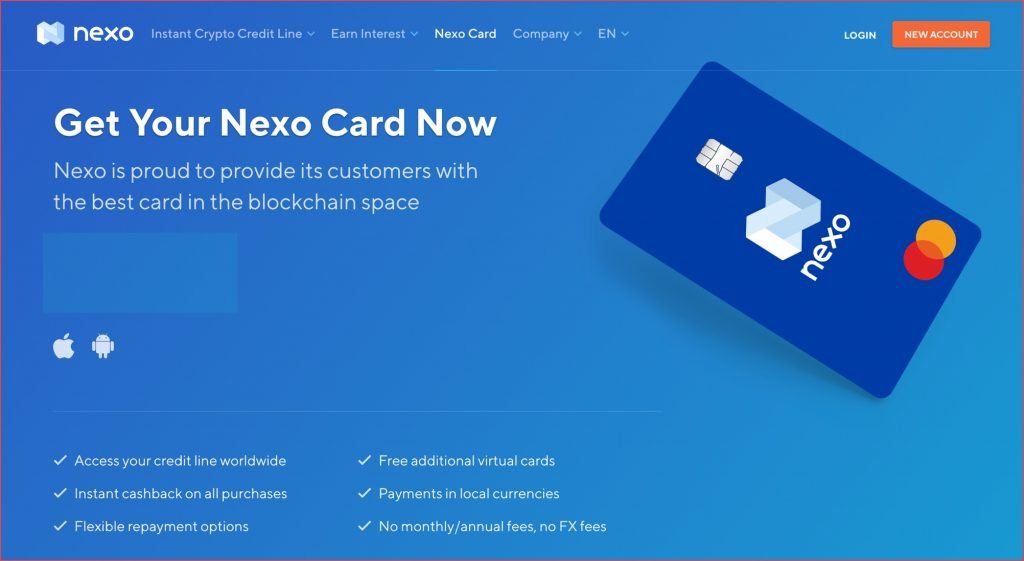

NEXO Card

Nexo is very popular service, primarily for crypto loans but they also plan to launh their own debit card – both physical and free Virtual cards for safe online purchase. Nexo wallet (you don’t own the keys, better use hardware wallets) offers zero transaction fees and you can easily use your existing funds to use with your card. There will be no monthly/annual fees.

Features of Nexo card:

- Freeze and Unfreeze your card with a single tap.

- Create free virtual cards for online purchases

- Cashback on all purchases

- Payment in local currencies

- View your Pin and change it at any ATM

Get on Nexo card wait list

Bitwala Visa Debit Card

Bitwala’s crypto debit card is another premier Bitcoin debit card by the company that gained fame for its ability to pay bills with Bitcoin. This is the most affordable bitcoin debit card on the market, both in terms of card price and the lowest, transparent fees that follow card usage. Bitwala issues prepaid debit cards that can be used with 44 cryptocurrencies and 20 currencies worldwide. The Bitwala team is based in Berlin since 2012. The 15 000+ Bitwala users are spread across 120 countries. They use one of the fiat or cryptocurrencies with great pleasure.

| Bitwala Bitcoin Debit Card | |

| Availability | EEA |

| Supported Currencies | EUR, BTC |

| Card Option | Physical |

| Card Type | MasterCard |

| Fees | Low |

| Native Token | No |

| Perks/Bonuses | No |

The Bitwala debit cards are issued in both virtual and physical forms. They cost €2.00 and can be funded with 20 different currencies and 44 cryptocurrencies. Besides the usual USD, EUR and GBP accounts, user may use the Bitwala bitcoin debit card with all European currencies, many currencies in Asia AUD and a couple of currencies in South America. Issuing the PIN code cost 0.80 EUR, while the monthly service fee is €1.

Denominated in Euros, you can use the Bitwala debit card to pay online and offline where VISA is accepted, and cardholders can also cash out at any ATM worldwide with the best rates and transparent fees. ATM withdrawals at domestic machines cost 2.25 EUR. On the other hand, ATM withdrawals at international machines cost 2.75 EUR+ 3% currency exchange rate. As you can see, withdrawing money from ATMs costs a little less than the market average.

Bitwala offers 2 shipping plans for their bitcoin card:

- Free of charge (after ordering, the card arrives within 7-10 business days)

- For an extra fee of €69 the expedited shipping only takes 3-5 days.

PROS:

- It has good pricing structure

- It supports 44 altcoins and 20 currencies

- The owners work as C-level directors in the company

CONS:

- It is not available to US citizens

- There is no search function in FAQ

- It uses third party bitcoin exchanges, not own exchange price

BitPay VISA Debit Card

Although this is the newest kid on the block, BitPay’s crypto debit card is probably the most exciting of the bunch. Bitpay is a well known company in the Bitcoin ecosystem. It provides payment solutions for individuals and businesses. It is the first Bitcoin debit card that is available to US residents from all 50 states, but you must have a home address (no PO boxes), Social Security number, and government-issued ID to apply.

| BitPay Bitcoin Debit Card | |

| Availability | USA |

| Supported Currencies | USD, BTC |

| Card Options | Physical/Virtual |

| Card Type | Visa |

| Fees | Low |

| Native Token | No |

| Perks/Bonuses | No |

The card costs a low $9.95 to obtain and there is also no charge to change your PIN (most cards here have a $1 charge.) This card arrives 7-10 days after purchase. It works with any ATM that works with VISA cards, and can also be used online, in-person.

You will pay a fee of 3% when traveling outside of the US to cover the cost of currency conversion. There is a $3.00 fee for any ATM or cash-back withdrawals outside of the US and a $2.00 fee for ATM or cash-back withdrawals inside the US.

Benefits include the highest limits of this comparison, because each card can hold up to $25,000 in funds, and up to $3,000 can be withdrawn daily, $750 at a time. These numbers are all highest in this review, which removes the need for any verification at all.

This card is exactly what you would want in a Bitcoin debit card. Customer support has been solid and the online account is easy to use. Transfers into dollars can be done in less than one minute and no documents needed for high limits.

PROS:

- Card is accepted worldwide

- Well known and established company

- Plenty of security and currency options to choose from

- Online account is easy to use

- Solid customer support

CONS:

- It requires verification

- It doesn’t have chip and PIN

- It is limited to US citizens only

Services to Avoid

- BitPlastic– It was among the first Bitcoin debit cards, but they do not appear to be innovating much. Supposedly they are TOR compatible. However, whenever I try to use their services, I get strange error messages. Maybe there is too much cyber security on my computer for them!! To get started, BitPlastic actually encourages you to use TOR email and a fake name. Your name is not printed on the card because it does not require your ID. This is a double-edged sword. You can take money out of ATM’s anonymously. However, it can be difficult to find an offline merchant who will accept a nameless card at checkout.

Summary

No card is perfect and most of these cards are more or less the same. The difference is only in their branding because they probably all use the same card supplier to run their business. However, the market has come a long way since BitPlastic, and just because you own Bitcoin does not mean you can’t shop conveniently, anywhere in the world.

You now have plenty of solid options, but I recommend to make sure the bitcoin debit card you choose is available in your country and then use the one with the lowest fees. For example, using Coinbase Card is a reasonable option if you live in the US