Single parents are most likely to skip meals due to rising food costs, new Which? research reveals.

Millions of households across the UK are struggling to make ends meet during the cost of living crisis, but Which? has found that parents - especially single parents - are being hit particularly hard.

Which? is calling on supermarkets to do more to help struggling families as part of its Affordable Food For All Campaign.

Single parents skipping meals

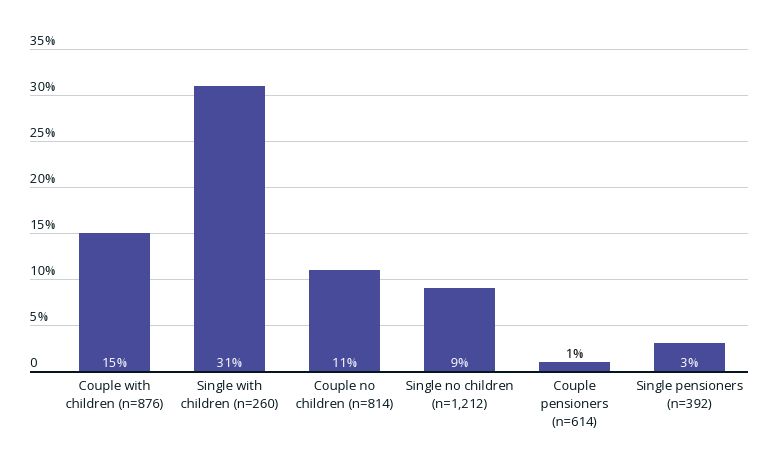

Our monthly Consumer Insights Tracker* found three in 10 (31%) single parent households surveyed said they had skipped meals due to rising food prices - compared to one in seven (15%) of parents in couples and one in seven (14%) of all those surveyed.

Source: Which? Consumer Insight Tracker*

A 43-year-old woman from the North West of England said: 'I can’t do anything other than pay bills and can barely feed my children some weeks. I walk around the supermarket adding up what I can spend.'

Another 34-year-old respondent from Scotland said: 'I’m not eating properly so that I have enough money to feed and clothe my kids and still have enough to put in my electricity meter… I don’t know what I will do once it gets cold… I worry about this daily while trying to make sure my kids are eating as healthy as possible, which is hard when you’re on a budget.'

- Find out more: the most at-risk areas for affordable food

Why are single parents struggling?

Which? analysed data* from the Office for National Statistics (ONS) and found that different household types experience different levels of lived inflation.

Single parent and retired households have experienced a particularly high lived inflation rates compared to other family types, because they spend a greater chunk of their budget on food, energy and fuel, which have all seen large price hikes during the cost of living crisis.

Source: Source: Which? Analysis of ONS Inflation and ONS LCFS data

We've estimated single parents and retired households spent just under a third (30%) of their income on energy, food and fuel from September 2022. This drops to a quarter (25%) of their income for couples with children and for single households without children (24%) or a fifth (22%) when looking at couples without children.

How are families coping with the cost of living?

All households are spending significantly more of their income on essentials than they did a year ago.

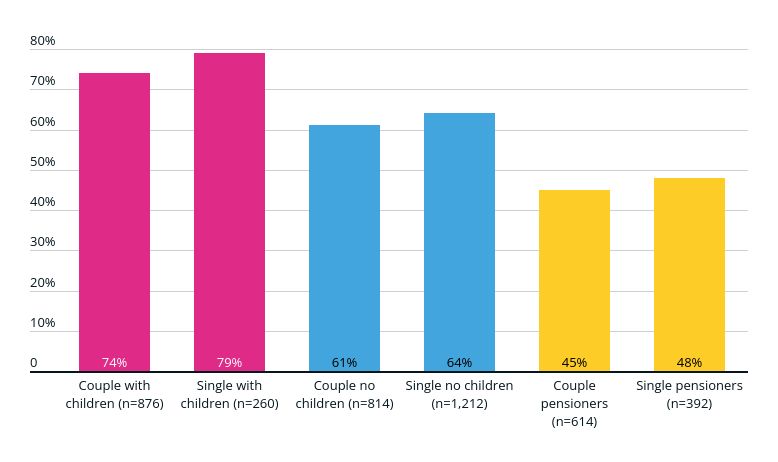

However, Which?’s Consumer Insight Tracker research found parents - especially single parents - are making the most financial adjustments due to the rising cost of living.

Source: Which? Consumer Insight Tracker*

Nearly eight in 10 (79%) of single parents and three quarters (74%) of couples with children surveyed said they had made at least one financial adjustment – such as cutting back on essentials, selling items or dipping into savings – in the last month to cover essential spending. This compares to just six in 10 (62%) among everyone surveyed.

Families struggling to make ends meet

Worryingly, almost one fifth (18.8%) of single parent households and one in seven (13.7%) of couples with children in our survey said they had missed or defaulted on a vital payment in the last month – such as a mortgage, rent, credit card or bill payment – in September and October.

On average, the missed payment rate was 8.2% across September and October, compared to 6.2% in September last year.

Pensioners were by far the least likely to have missed a payment. However, the single pensioners surveyed were more than twice as likely to report a missed payment (2.6%) than pensioner couples (1%).

Our research also found that one in seven (15%) parents would struggle to pay an unexpected but necessary bill of £300. They are also the household type most likely to be relying on food banks.

One in 10 (8%) of single parents and 5% of parents in couples we surveyed said they had used a food bank in the last two months. This compares to just 3% of those surveyed overall.

'I'm paying the same price for less'

Paul is an unpaid carer in his fifties. He lives with his wife, adult daughter and son in Milton Keynes. His son has a severe developmental disability.

Talking about his food shopping, Paul told Which?: 'I used to come home with four or five bags, but now it's three bags. I'm paying the same price for less products - even with the special offers. Meat is very expensive now. I think Sunday lunch will be a thing of the past.

'I sometimes go without eating as I prioritise food for my son. I've lost a lot of weight since April.'

- Find out more: how to spend less at the supermarket

Which? calls on supermarkets to do more

Which? believes that essential businesses, such as supermarkets, have an important role to play in helping consumers during the cost of living crisis.

As part of its Affordable Food For All campaign, the consumer champion has published a 10-point plan setting out specific steps supermarkets can take in three main areas: clear and transparent pricing, improving availability of affordable food ranges across all stores and more targeted promotions for customers who need them most.

Which? has developed a unique Priority Places for Food Index, with the Consumer Data Research Centre at the University of Leeds, which uses data from a range of indicators to identify where people in different parts of the UK are most likely to be struggling and need most support.

- Do you want to see supermarkets take action? Sign our petition.

*How Which? conducted the research

The Consumer Insight Tracker is an online poll conducted monthly by Yonder on behalf of Which?. It is weighted to be nationally representative with approximately 2,000 respondents per wave. Two waves of our monthly Consumer Insight Tracker were merged for this analysis to provide additional sample for analysis within subgroups of the sample. The fieldwork was conducted by Yonder on behalf of Which? between 9-11 September 2022, and 12-14 October 2022. The overall sample size is 4,192 adult consumers in the UK. Sample sizes for household groups mentioned are as follows: Couples with children (876), single parents (260), couple pensioners (614), single pensioners (392), couples without children (814), single without children (1,212). Percentages for household subgroups are unweighted and not nationally representative.

‘Lived inflation’ calculations are based on Which? analysis of ONS data on inflation and household spending. Estimated inflation rates are 9.1% and 10.1% for single parent and retired households, respectively. Please note that inflation rates are based on the Consumer Prices Index including owner occupiers’ costs (CPIH) as opposed to the CPI and refer to the 12 months up to September 2022. Further details on the methodology can be found here.

source https://www.which.co.uk/news/article/single-parents-most-likely-to-skip-meals-during-the-cost-of-living-crisis-apS8f7N0BPqS